Oracles

Every token in a silo uses an oracle which are third-party applications that provide updated token prices on-chain. For technical information, read this document.

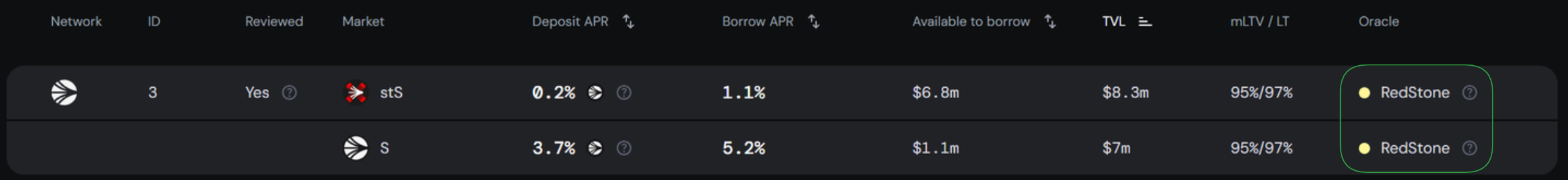

For example, the stS-S silo uses Redstone oracles for both stS and S price feeds.

Oracle prices plug into other modules, such as borrowing parameters, to define current LTV.

Each silo can use up to two oracles per token - for borrowing power and solvency.

Providers

Silo is oracle-agnostic, meaning developers may deploy markets with any oracle of choice.

Currently, The Silo Protocol provide oracle adapters for Chainlink, Redstone, Pyth, DIA, ERC-4626, and more. View adapters here.

Pricing Method

Oracles can use different pricing methods to determine how their prices are derived.

Market Oracles

Market Price oracles typically aggregate a token's price across multiple exchanges with some weighting methodology to output a single price.

Fundamental Oracles

Fundamental oracles price derivative tokens based on their backing value rather than market price to mitigate short-term peg volatility.

This may be used in cases like wstETH/ETH where wstETH is redeemable at an increasing ratio for ETH.

Reserve Oracles

Reserve oracles price derivative tokens based on reserve balance rather than market price to mitigate short-term peg volatility.

This may be used in cases like tBTC/BTC, where tBTC is redeemable 1:1 for BTC.