Supply

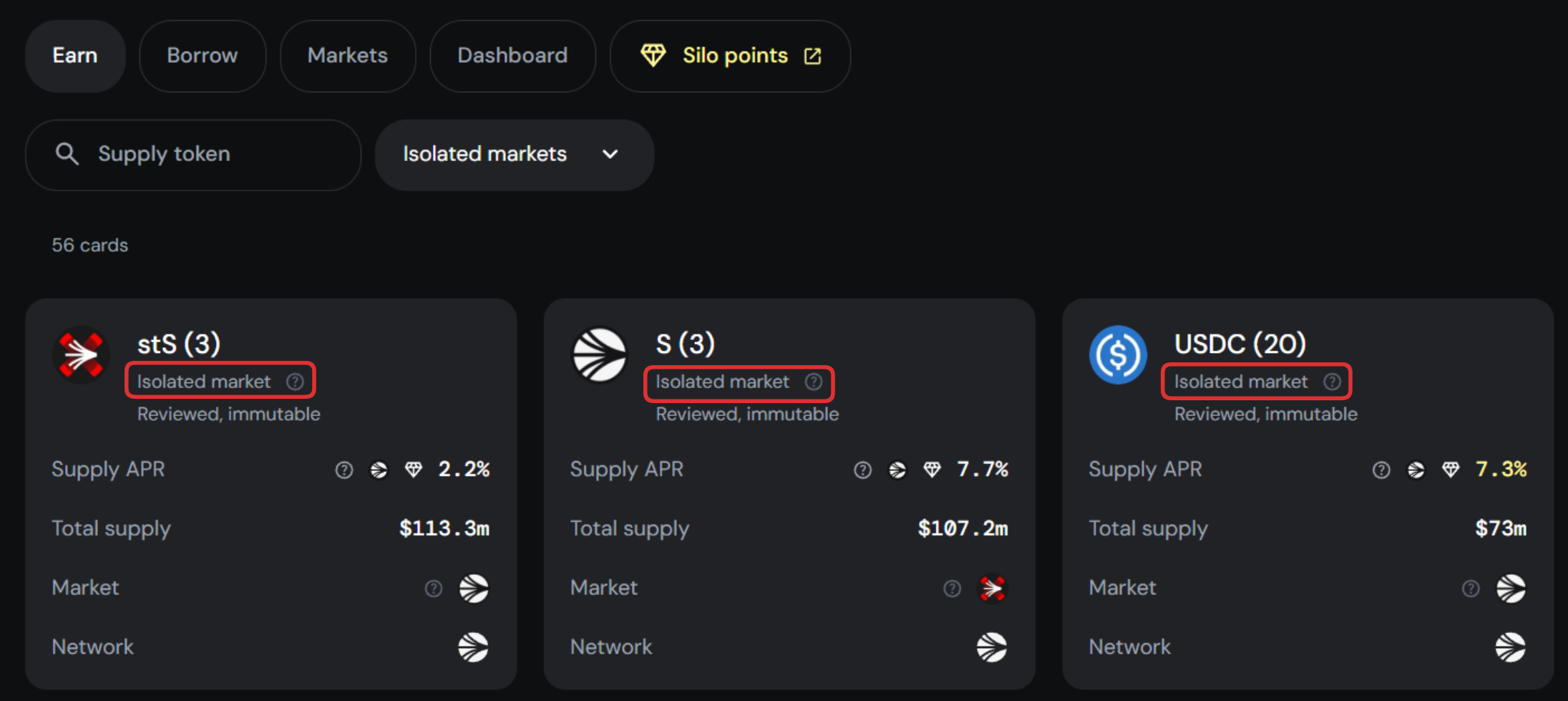

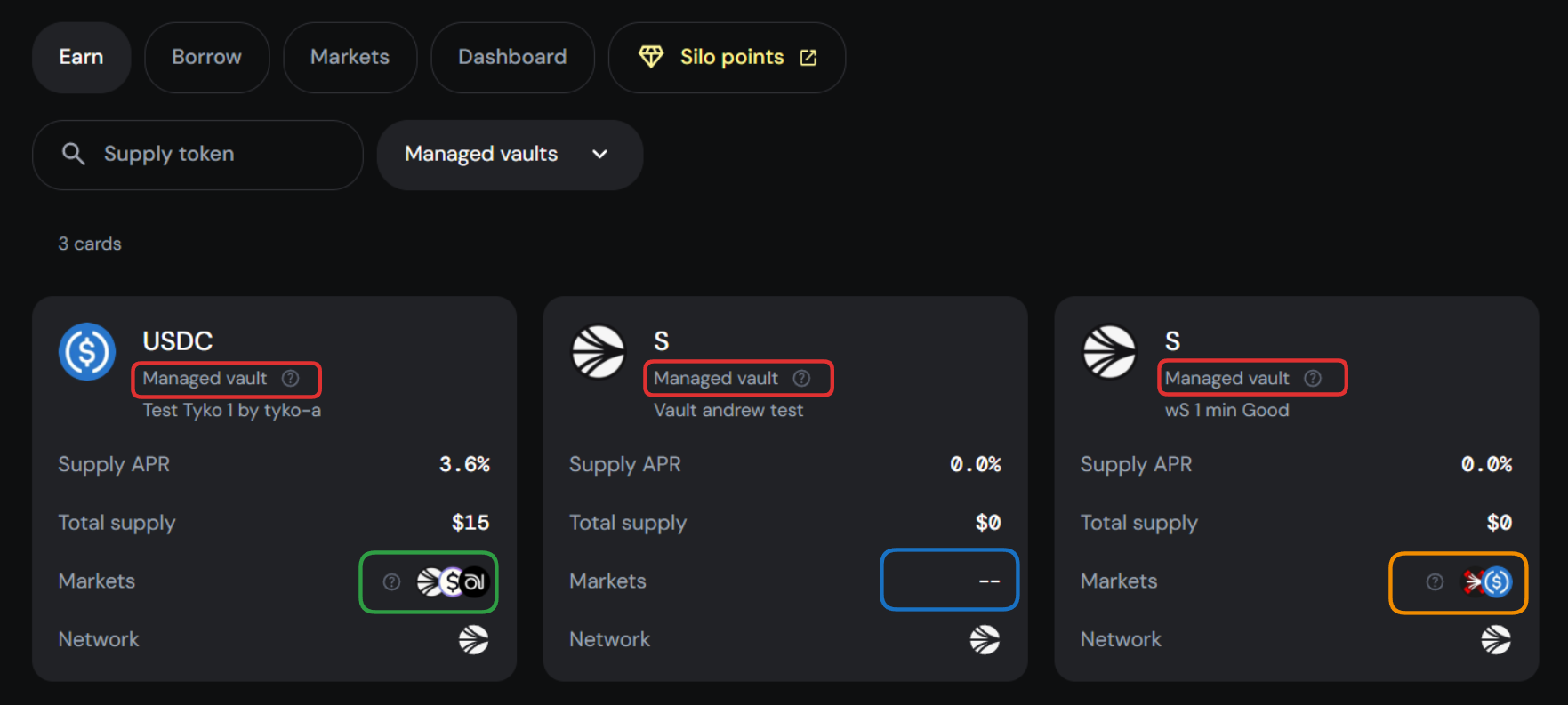

Users can deposit tokens in an isolated market (silo) or Managed Vault to earn interest from borrowers.

- Isolated Market (silo): Users can deposit into a silo and enjoy the protection of risk isolation while having the ability to borrow the other asset in the market.

- Managed Vault: Users can opt to deposit into a managed vault where the vault's manager can shift deposits among defined markets (silos), seeking optimized yield while managing risk. Depositing into a managed vault does not support borrowing.

Supplying

Isolated Markets (silos)

Deposits are represented by receipt tokens that increase in value due to auto-compounded interest. Tokens supplied to a silo may be borrowed out by other users who supply collateral into the same silo.

Users may deposit tokens as non-borrowable collateral that other users cannot borrow. Non-borrowable deposits don't earn interest.

Since each silo has two tokens only, suppliers know their exact counterparty exposure when depositing as displayed on the UI under 'Market'.

Managed Vaults

Vaults are meant for passive depositors. Deposits cannot be used as collateral for borrowing. If you'd like to borrow, deposit into a silo instead.

Tokens deposited into a vault can be allocated to any of its whitelisted silos at the discretion of vault managers and may be borrowed by other users who provide collateral to those silos.

A vault depositor's net exposure may be shared between multiple underlying silos which is displayed on the UI under 'Markets'.

Withdrawing

Suppliers may withdraw their deposit, including accrued interest, at any time. The exception is when liquidity is fully utilized where interest rates are expected to be high to encourage repayments and attract new deposits.

The user's ERC-4626 receipt token is burned upon withdrawal in exchange for the underlying token.