Yield Optimization

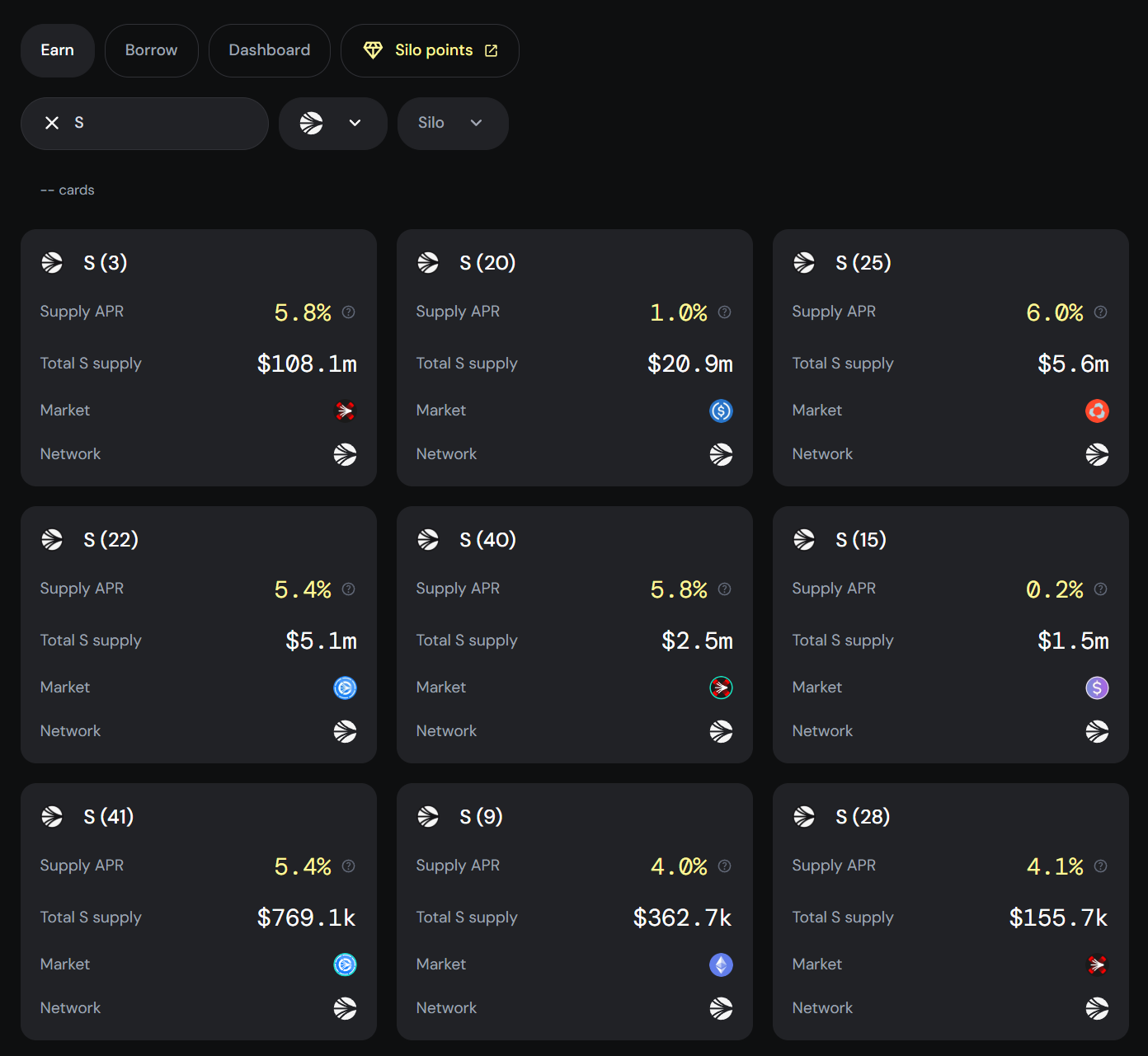

Silo's isolated design means there could be multiple markets accepting the same token for deposits. This can be time-intensive for optimizing yield, as it could require active rebalancing.

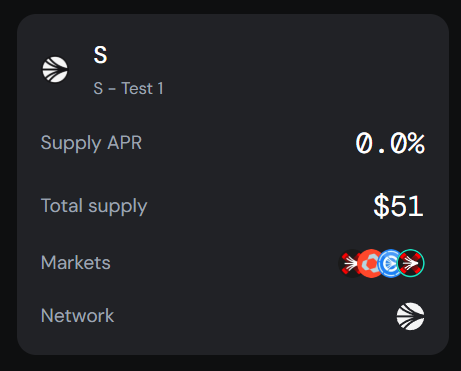

Managed Vaults can allocate single-sided liquidity to curated markets, allowing managers to rebalance for depositors to maximize yield.

For example, an $S vault could have the following whitelisted markets:

- stS-S

- wanS-S

- wOS-S

- PT-stS The vault manager can move $S between these markets to target a higher depositor yield.