Isolated Pairs

Every Silo consists of two tokens that can be used for lending or borrowing within that market. By default, silos are two-sided, meaning Token A can borrow Token B and vice versa. This creates yield opportunities for deposits of both assets.

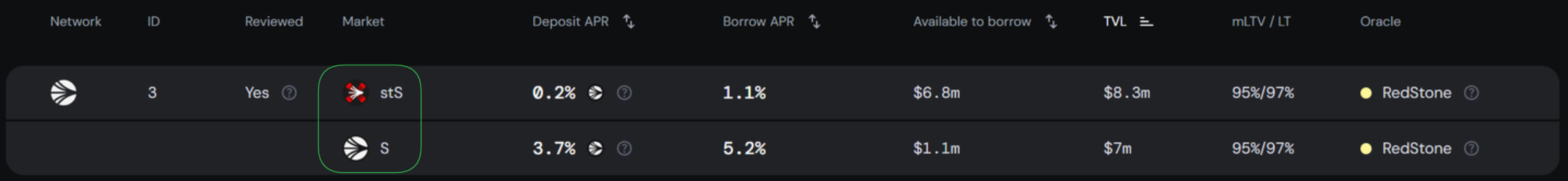

Take, for example, markets stS-S [3] silo and S-USDC [20]. S in market 3 can only borrow stS. However, it cannot borrow USDC in market 20 because the two markets are isolated. Similarly, stS in market 3 can borrow S in the same market, but cannot borrow S in market 20.

Isolated pairs let users define their risk exposure when choosing a market. This contrasts with shared-risk lending protocols, where risk is shared amongst all depositors, irrespective of the token they deposit.