Interest Rates

Each token in an isolated market (silo) has an algorithmic Interest Rate Model (IRM) that adjusts the borrow interest rate (IR) based on the token’s utilization in the market, setting higher rates when utilization is high and lower rates when utilization is low.

By setting interest rates algorithmically based on utilization, the protocol ensures sufficient liquidity for depositors to withdraw while earning demand-driven interest from borrowers, maintaining a supply-demand equilibrium.

Interest Rate Configurations

Silo's isolated markets are IRM-agnostic, meaning markets can be deployed with any Interest Rate Model and configurations. The Silo Core Team usually deploy markets using Silo's own Dynamic IRM.

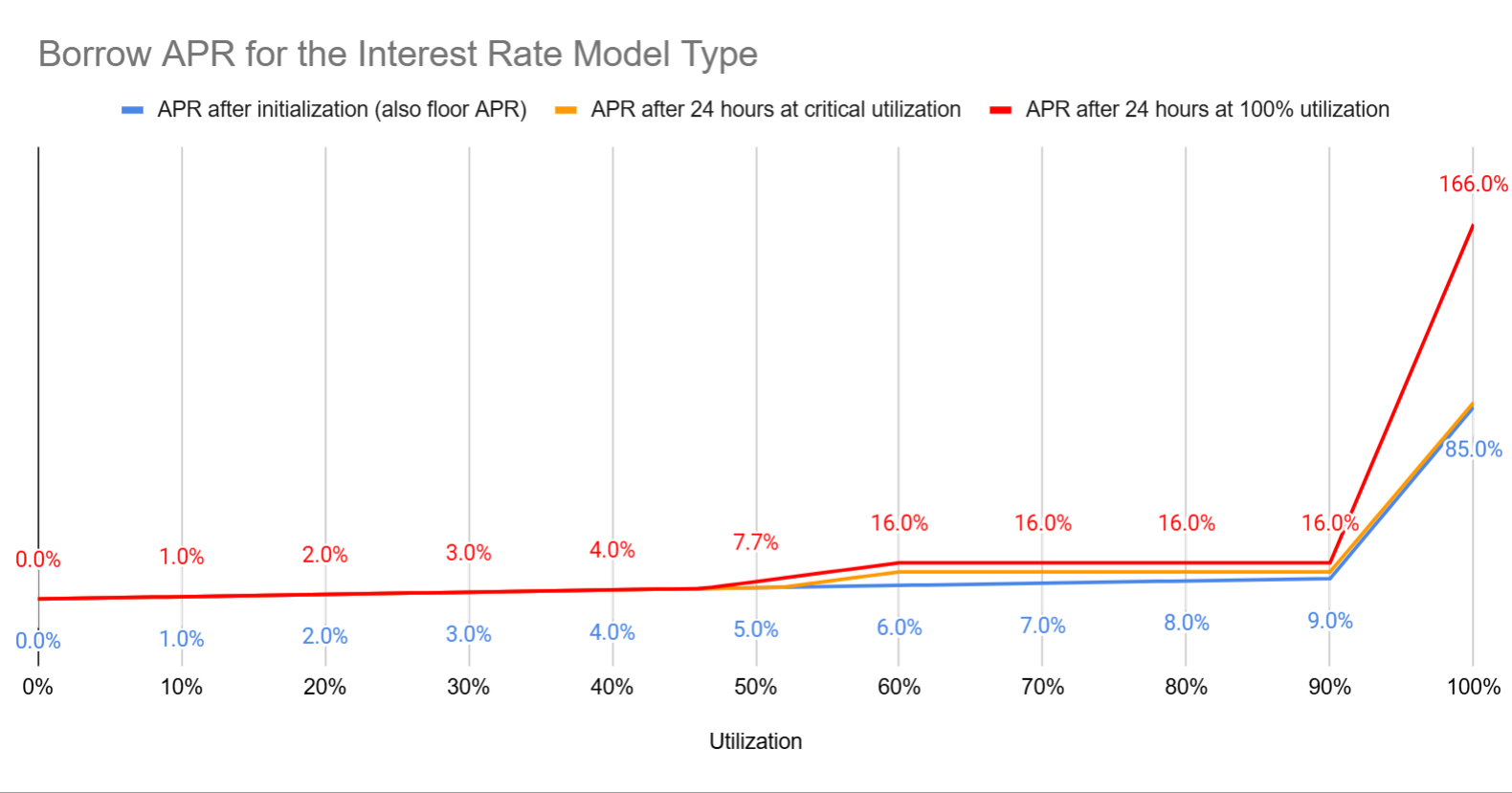

Dynamic Kink with PI Controller

The Interest Rate Model establishes an optimal utilization range where borrow interest rates remain stable. When utilization exceeds this range, rates shift from stable to dynamic, rising above the floor rates established in the optimal range. The dynamic increase in interest rate happens every block and aims to incentivize a return to optimal utilization by attracting deposits or encouraging loan repayments.

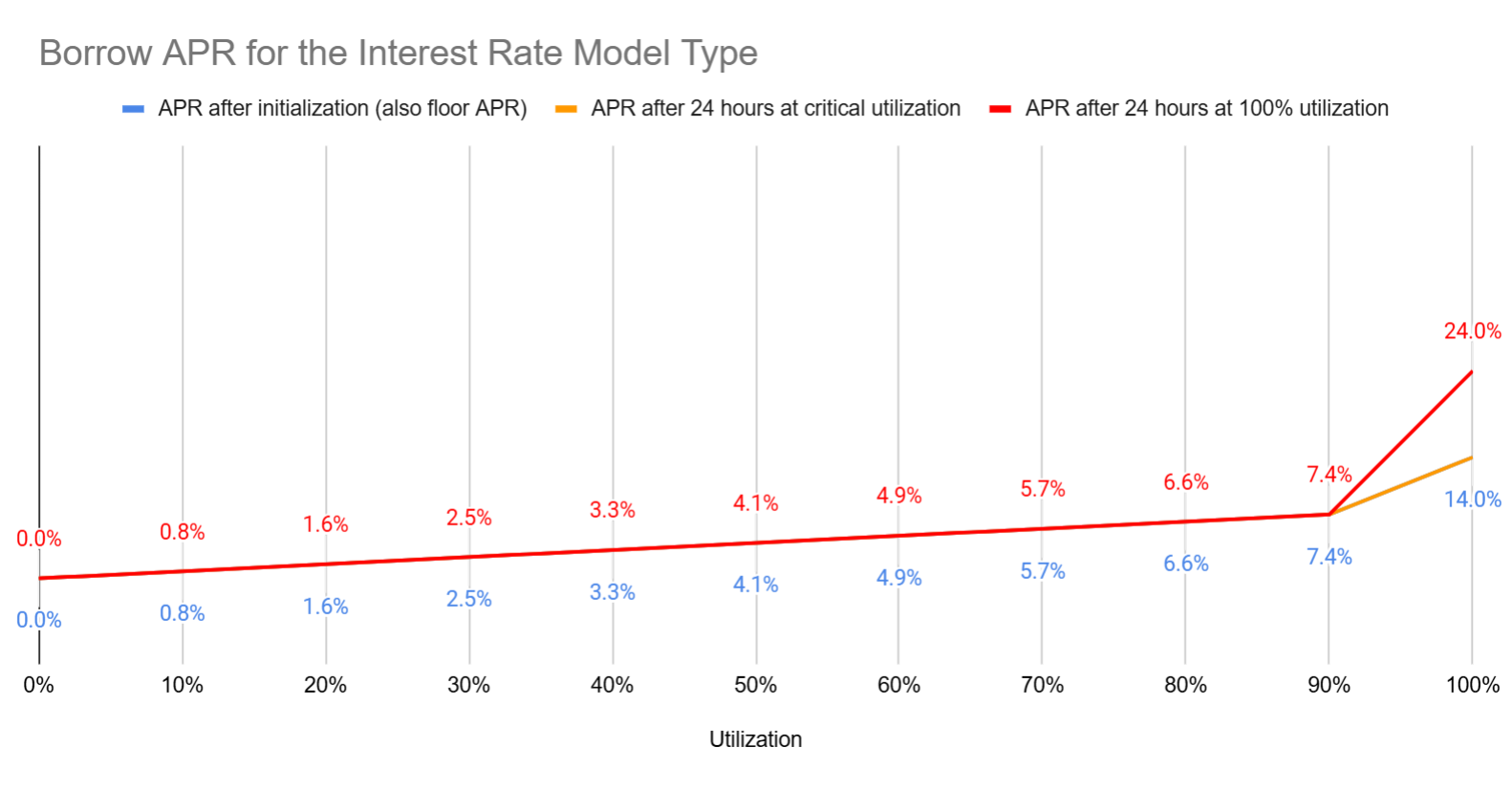

Dynamic Kink

This model has a gradual rate progression where borrow rates increase linearly with utilization.

It has a critical utilization threshold where rates will increase rapidly to encourage new repayments and deposits.

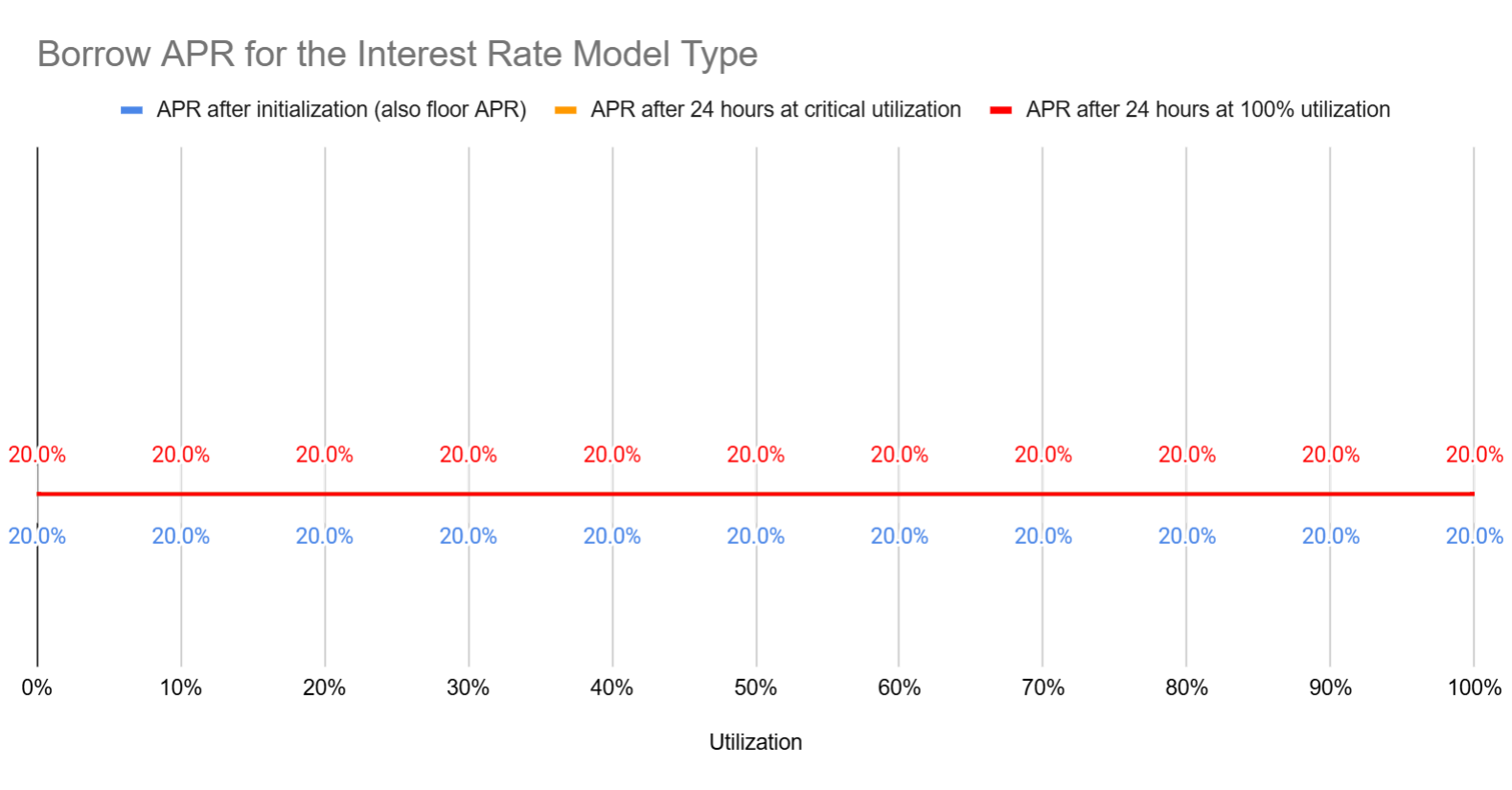

Fixed

In some cases, markets might have a fixed interest rate where the IR remains stable at all utilization levels.

This is ideally paired with fixed yield tokens such as Pendle PTs.