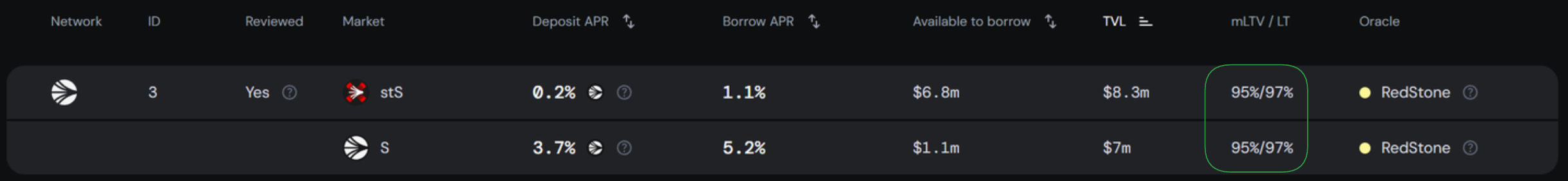

Borrowing Parameters

Every token in a given silo has a defined maximum Loan to Value (mLTV) and Liquidation Threshold LT that define the borrowing power and solvency requirements of that token.

In this example, stS has an mLTV of 95% and an LT of 97%. This means a user can borrow 95% of their stS deposit and they might experience partial liquidation if the loan value exceeds 97% of their collateral value.

LTV

LTV is the current loan-to-value ratio of a user's position given by:

Events that can change a user's LTV include:

- New deposits, withdrawals, loans, and repayments

- Change in loan token's price

- Change in collateral token's price

- Interest earned on collateral

- Interest paid on loan

mLTV

mLTV is a token's maximum LTV, indicating its maximum borrowing power.

An mLTV of 95% means a user can borrow 95c per $1.00 in collateral.

If a position has exceeded its mLTV, additional tokens cannot be borrowed unless collateral is added.

LT

LT is the token's liquidation threshold, indicating the maximum LTV a position can have before it is signaled for liquidation.

An LT of 97% means a user may be liquidated if their LTV exceeds 97%.

Users may improve their LTV by depositing more collateral or repaying their loans.