stS · S (ID 3)

Risk Report

This risk report pertains to stS · S on Sonic network (ID 3)

Liquidation

Liquidations due to market fluctuations are extremely unlikely because the market uses stS/S contract rate (not the asset market rate). However, your borrow position might become insolvent if your loan has significantly grown due to accumulated interest faster than the growth in your collateral value. Since stS accrues yield automatically, your collateral value should increase over time to cover accrued interest.

Keep an eye on your position’s Health Factor and ensure it remains positive. Your position becomes insolvent when Health Factor drops to 0%.

Oracle

The stS/S market uses a RedStone Contract Rate Feed (Fundamental oracle) that reports the value of stS/wS from stS staking contract. Since this market is immutable, the oracle cannot be changed.

Erroneous pricing in the external oracle could result in losses. SiloDAO doesn’t have control over oracles. See terms.

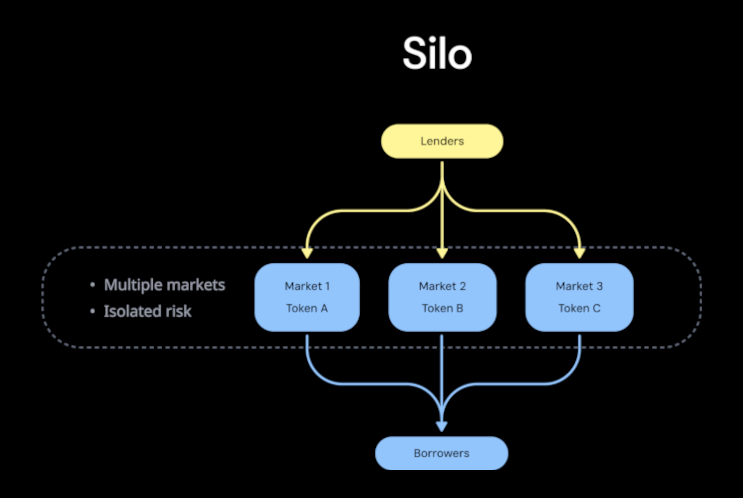

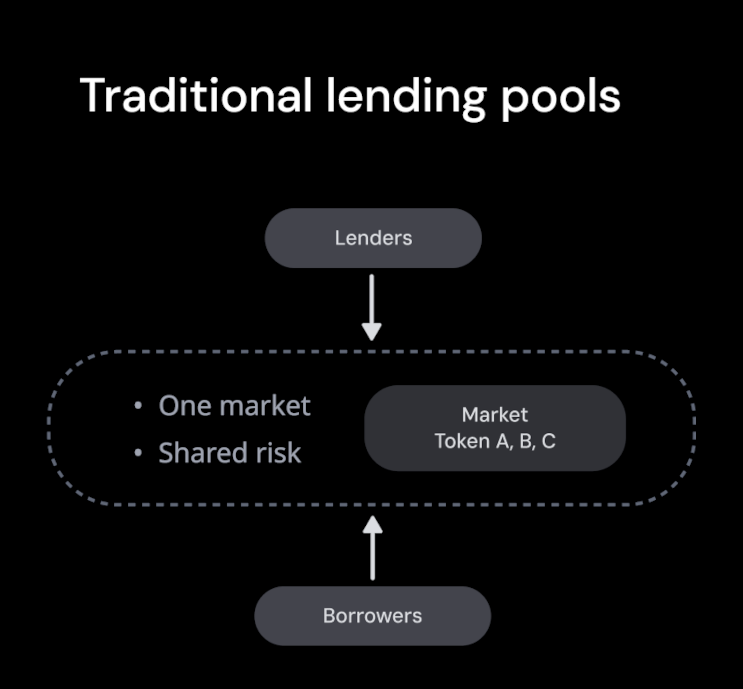

Risk from other markets in the Silo protocol

The stS/S market is completely isolated from other markets. An exploit, misconfiguration, or the inability to liquidate in other markets doesn’t impact your position.

The risk report doesn’t cover smart contract risk, all economic risks, or the risk of the underlying assets, so it should not be construed as a guarantee of safety.

Silo v2 markets are permissionless to deploy. Choose markets carefully.