Introduction to Silo Vaults

What are Silo Vaults?

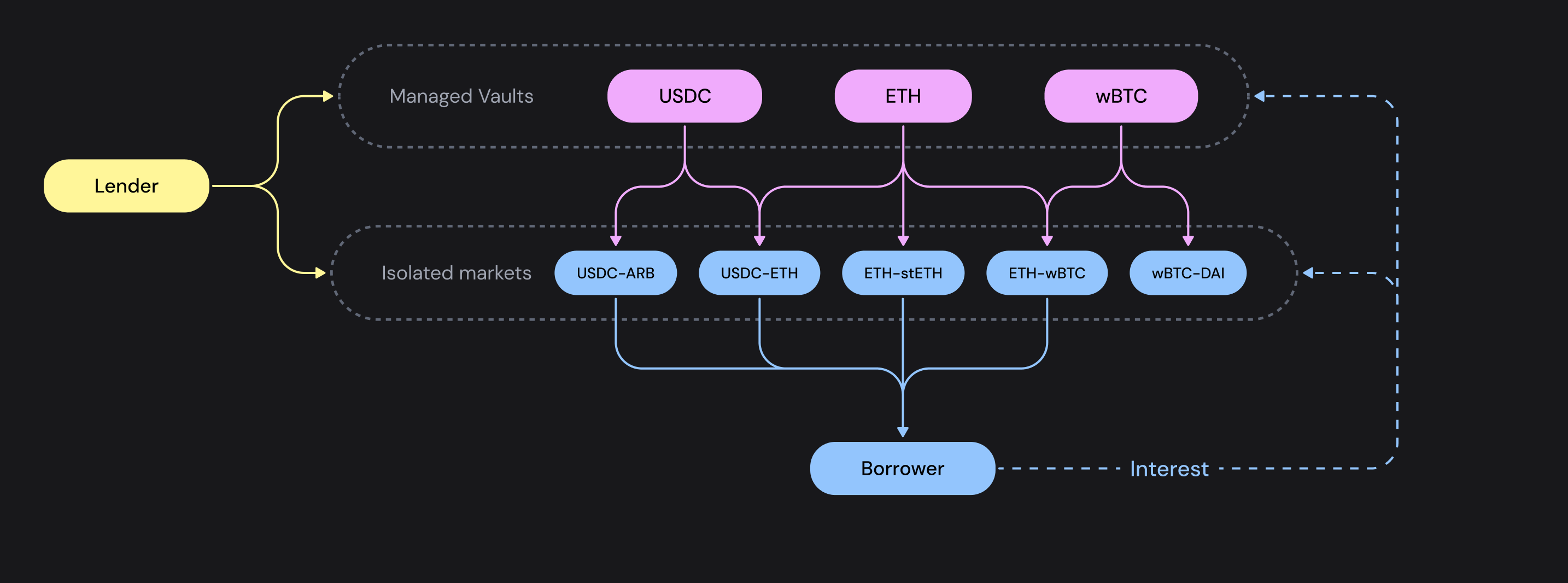

Silo Vaults are ERC-4626 contracts built on top of Silo markets, with deposits managed by third-party managers. Anyone can deploy a Silo Vault, and any wallet user can deposit into a vault in a non-custodial manner. Vault managers discretionarily allocate deposits to optimize yield for depositors while minimizing risk exposure. In exchange for their services, vault managers charge a performance fee, a percentage of the interest earned by the vault.

Vaults inherit the risk-isolated design of the Silo Protocol at the market level but may have diversified yield and counterparty exposure depending on their markets and fund allocations.

Vault Users

Suppliers

Users or protocols can deposit tokens into a vault to earn interest and additional rewards if the underlying markets receive incentives. Tokens can be supplied through the Silo lending app or by directly interacting with the vault contract.

Vault Managers

Users, or protocols, that manage vault deposits.

Applications

External applications, such as yield optimization, DEXs, and more, can build on top of Silo vaults to provide liquidity.